How to Calculate Beta of a Portfolio

It is used in the capital asset pricing model. Coverage for local areas varies.

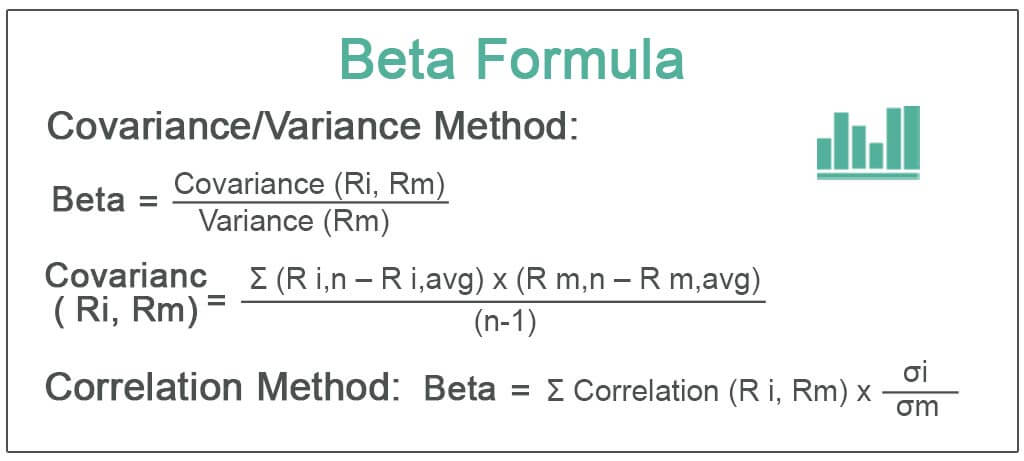

Beta Formula Top 3 Methods Step By Step Examples To Calculate Beta

For instance if a companys beta is equal to 15 the security has 150 of the volatility of the market average.

. A beta of 20 means the stock moves twice as much as the SP 500. Calculating CAPM Beta in the xts World. Using a stock screener with powerful financial analysis is the easiest way to calculate complex financial ratios like Beta.

Read more Capital Asset Pricing Model for calculating the rate of return of a stock or. Thus beta is a useful measure of the contribution of an individual asset to the risk of the market portfolio when it is added in small quantity. Over-the-counter OTC or off-exchange trading or pink sheet trading is done directly between two parties without the supervision of an exchange.

When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level. Beta is a measure of the volatility or systematic risk of a security or a portfolio in comparison to the market as a whole. Put simply the expected return of a stock is equal to the risk-free rate plus beta times the market risk premium.

Beta is used in the capital asset pricing model CAPM which. Get 247 customer support help when you place a homework help service order with us. To calculate beta start by finding the risk-free rate the stocks rate of return and the markets rate of return all expressed as percentages.

Beta 1-Year Beta 3-Year. After filling out the order form you fill in the sign up details. Beta is a measure of the volatility or systematic risk of a security or portfolio in comparison to the market as a whole.

You can use a calculator or the Excel function to calculate that. However the T-bill is generally accepted as the best representative of a risk-free security because its return. The returns for the portfolio or any asset whose beta we wish to calculate and the market returns.

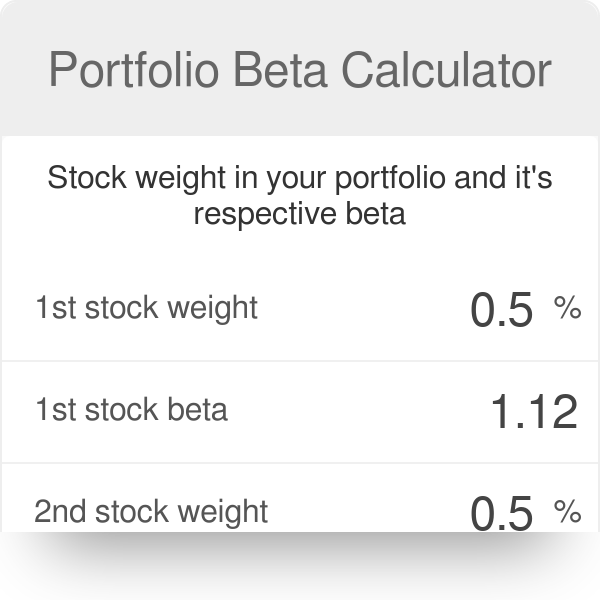

Based on these values determine how much you have of each stock as a percentage of the overall portfolio. A beta of 10 means the stock moves equally with the S. Heres how to read stock betas.

Calculate your Portfolios Beta and Volatility with the functions as shown below. Lets say there are 2 securities in the portfolio whose standard deviations are 10 and 15. How To Calculate Beta.

Smart Beta ETFs Environmental Social and Governance ESG ETFs Bond ETFs. High Beta Stocks Versus Low Beta. Multiply those percentage figures by the appropriate beta for each stock.

Ensure you request for assistant if you cant find the section. It also considers the volatility of a particular security in relation to the market. A stock exchange has the benefit of facilitating liquidity providing transparency and maintaining the current market priceIn an OTC trade the price is not.

It is used in the capital asset pricing model. A dually registered investment advisor and broker-dealer. The default index used for calculations is SPY PortfolioBetaPortfolio PortfolioVolatilityPortfolio.

First we need to calculate the standard deviation of each security in the portfolio. A beta of -1 means security has a perfect negative correlation with the market. Expected return on an asset r a the value to be calculated.

Post-Modern Portfolio Theory PMPT is an extension of the traditional Modern Portfolio Theory MPT. You can explore local rates by Primary Health Networks PHN or Statistical Areas Level 3 SA3. Calculate the standard deviation of each security in the portfolio.

It is contrasted with exchange trading which occurs via exchanges. However if the beta is equal to 1 the expected return on a security is equal to the average market return. Lets go to the xts world and use the built-in CAPMbeta function from PerformanceAnalyticsThat function takes two arguments.

Using these values and the properties of the normal distribution we can make statements such as the likelihood of losing money even though no. We can make things even more efficient of course with built-in functions. The Beta is calculated in the CAPM model CAPM Model The Capital Asset Pricing Model CAPM defines the expected return from a portfolio of various securities with varying degrees of risk.

Once we have the value for a single day we just need to copy and paste the formula across all. The market risk premium is the expected return of the market minus the risk-free. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

For example monthly returns are used to calculate a funds mean and standard deviation. About a purchase you have made. Stock Rover has the following Beta Calculation.

The Easy Way to Calculate Beta. The coverage rates for all children at one year of age decreased by 018 percentage points to 9443 compared to the four quarters to December 2021. The portfolio allocation vector the 5 placeholder values with the daily security return series to calculate the portfolio return for a given day.

Put both high- and low-beta stocks in your portfolio for adequate diversification. Add up the weighted beta figures. Risk-free rate r f the interest rate available from a risk-free security such as the 13-week US.

If you are age 72 you may be subject to taking annual withdrawals known as required minimum distributions RMDs from your tax-deferred retirement accounts such as a traditional IRA. Provide AmericanBritish pronunciation kinds of dictionaries plenty of Thesaurus preferred dictionary setting option advanced search function and Wordbook. For example if Amazon makes up 25 of your portfolio and has a beta of 143 it has a weighted beta of 03575.

Stock Rover our review-winning stock research and analysis screener makes calculating Beta easy. In finance the beta β or market beta or beta coefficient is a measure of how an individual asset moves on average when the overall stock market increases or decreases. If you have a slightest of the hint regarding DCF then you would have heard about the Capital Asset Pricing Model CAPM CAPM The Capital Asset Pricing Model CAPM defines the expected return from a portfolio of various securities with varying degrees of riskIt also considers the volatility of a particular security in relation to the market.

Then subtract the risk-free rate from the stocks rate of. Treasury billNo instrument is completely without some risk including the T-bill which is subject to inflation risk. Beta is a measure of the volatility or systematic risk of a security or portfolio in comparison to the market as a whole.

Multi-faceted Portfolio Analysis At Your FingertipsRisk-Return AnalysisUse a comprehensive list of risk and return analysis functions in your Excel. Order status placement and cancellation. Beta.

How To Calculate Beta With Pictures Wikihow

Calculate The Beta Of A Portfolio In Excel The Excel Hub Youtube

How To Calculate The Beta Of A Portfolio Youtube

0 Response to "How to Calculate Beta of a Portfolio"

Post a Comment